how to calculate stamp duty malaysia

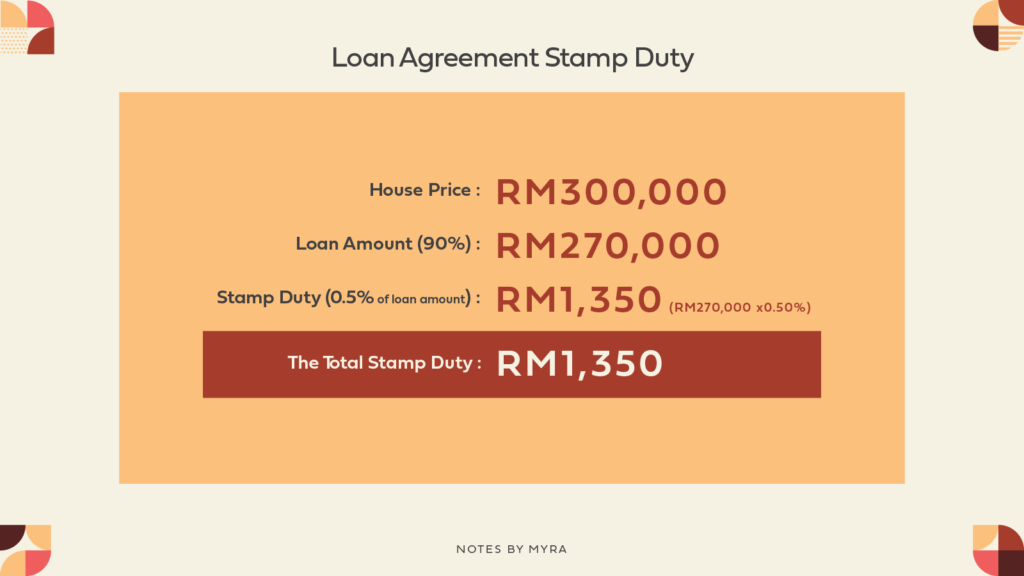

Ringgit malaysia loan agreements. Loan Tenure years.

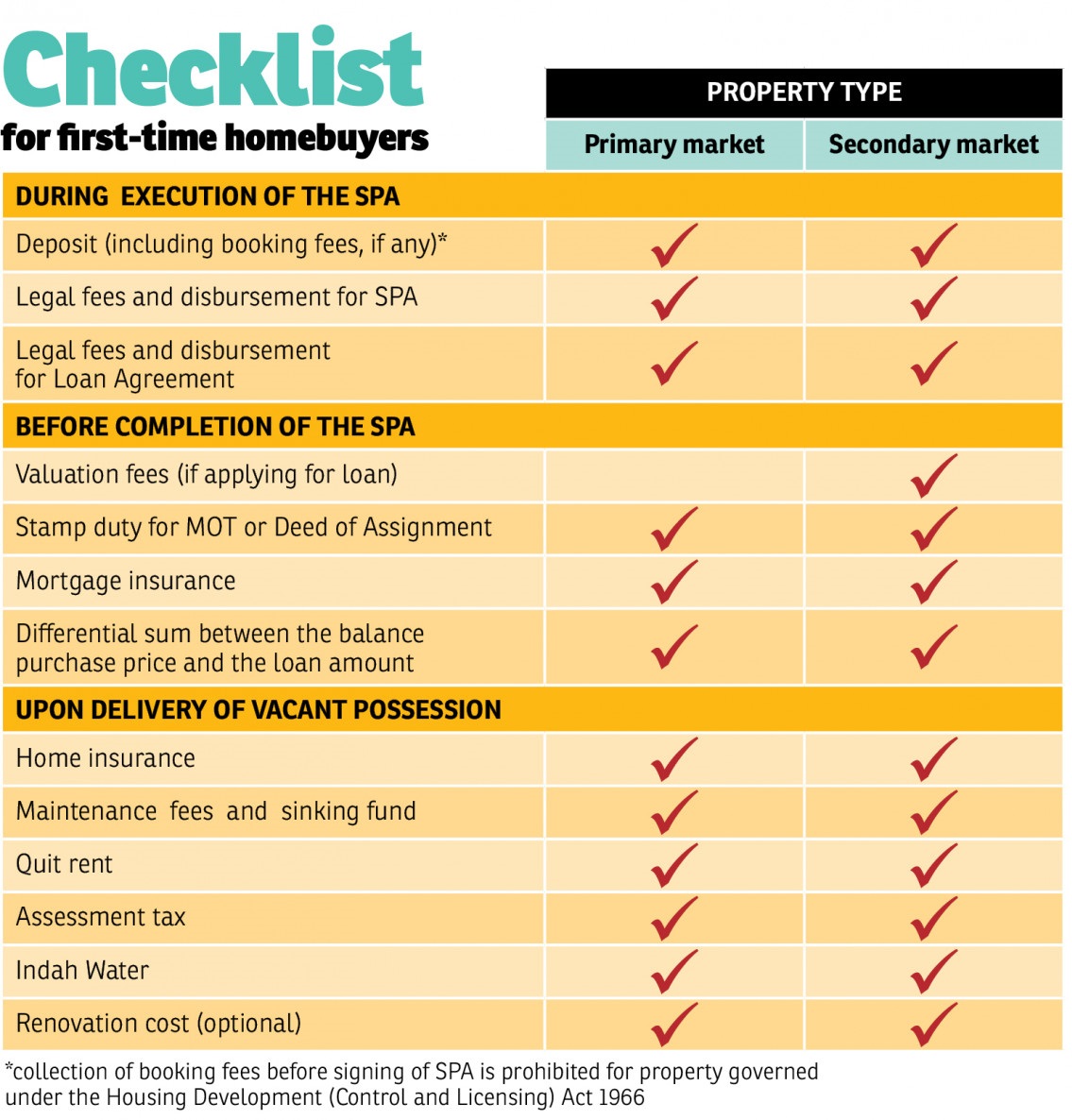

Lock Stock Barrel Set Aside Sum For Stamp Duty

Where the property price or the adjudicated value is in excess of RM7500000.

. A number of shares deemed to be a chargeable asset. Please note that the above formula merely provides estimated stamp duty. RM48 RM10 RM58 this total amount is for 2 copies of the Tenancy Agreement one for the landlord and one for the tenant.

Interest Rate. Ringgit malaysia loan contracts are generally taxed with a stamp duty of 05. For the next RM2500000.

Stamp Duty on MOT Stamp Duty Calculator Malaysia This calculator calculates the estimated or approximate fees needed for Stamp duty on Memorandum of Transfer MOT. Margin of Finance. To calculate the amount you need to pay for the stamp of your rental agreement enter your monthly rental and rental period in the computer below.

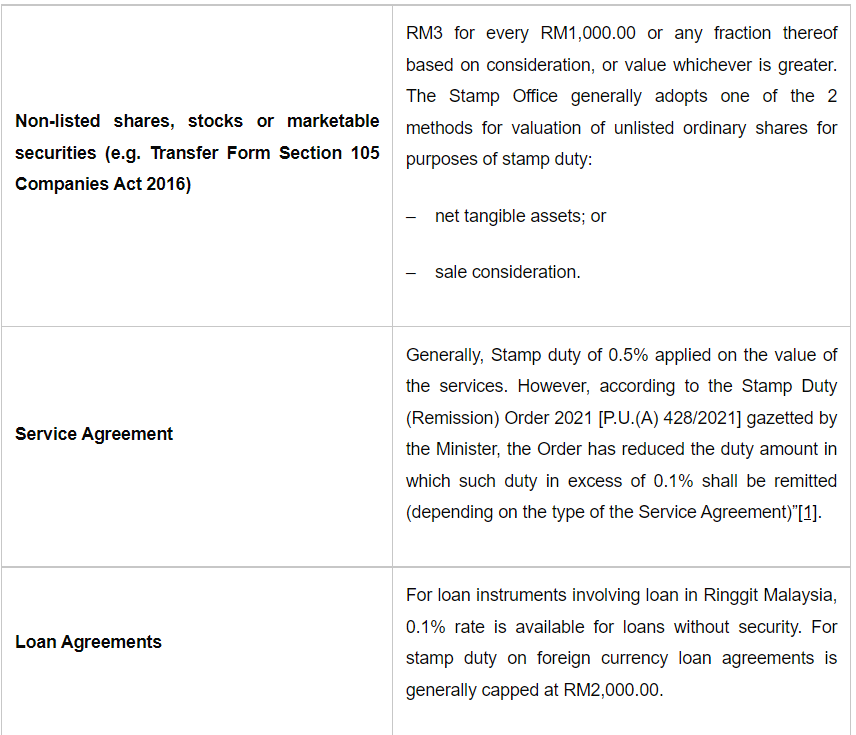

Shares or stock listed on Bursa Malaysia. Stamp Duty Payment Stamp duty payment can be. In general term stamp duty will be imposed to legal.

The Assessment and Collection of Stamp Duties is sanctioned by statutory law now described as the Stamp Act 1949. Negotiable on the excess but shall not exceed 05 of such excess. Manual Calculation Formulae as below or you can use the above Tenancy Agreement Stamp Duty Calculator Malaysia to help you calculate Malaysia Rental Stamp Duty Calculator For Example.

The rate of duty varies according to. Monthly Installment RM. B total number of issued shares in the relevant company at the acquisition date of the chargeable asset.

Total Purchase Price RM. Under the reforms SDLT is now payable on the portion of the transaction value which falls. The stamp duty for the sale and transfer of a property is calculated based on the purchase price.

Total Loan Amount RM. FORMULA Loan Sum x 05. This stamp duty calculation is base on Malaysian Stamp Act 1949 1st schedule item 32 a where every RM1000 loan that I get I need to pay stamp duty of RM 5.

You can pay stamp duty to. Rm5000 or 10 of the. Stamp Duty Loan Calculation Formula The Property Price must be less than RM500000.

RM1 for every RM1000 or any fraction thereof based on the transaction value increased to RM150 for every RM1000 or fractional part of RM1000. - Stamp duty exemption is capped at RM300000 on the property market value and loan amount. RM10000 or 20 of the deficient duty whichever is the greater if stamped after 6 months from the time for stamping.

Stamp duty for instrument of transfer Stamp duty on loan agreement Total stamp duty to be paid First RM100000 x 1 Next RM400000 x 2 05 of loan. You will get a. Additional copy of stamped Tenancy Agreement.

The actual stamp duty will be rounded up according to the. For example if I.

Spa Stamp Duty Mot Calculator Legal Fees Calculator Properly

Stamp Duty Calculation Malaysia 2022 And Stamp Duty Malaysia Exemption Malaysia Housing Loan

2022 Stamp Duty Legal Fees And 5 Other Costs When Buying A House In Malaysia Iproperty Com My

Stamp Duty And The Value Of Shares

Buying A House Here S 2022 Stamp Duty Charges Other Costs Involved

How To Calculate Legal Fees Stamp Duty When Buying A Property 1 Million Dollar Blog

This Lawyer Shares How To Calculate Stamp Duty For First Time Homebuyers

Best Home Loan Calculator In Malaysia With Legal Fees Stamp Duty Loanstreet

Cost Of Buying House In Malaysia

Malaysia S Latest Stamp Duty Update For 2018 Iqi Global

Malaysian Tax Law Stamp Duty Lexology

Stamp Duty Waivers Will Boost Housing Market Says Knight Frank Malaysia The Edge Markets

How Much Does The Stamp Duty For Your New Home Cost

Malaysia Legal Fees Cal Apps On Google Play

Stamp Duty Legal Fees New Property Board

How To Calculate Stamp Duty 2022 Malaysia Housing Loan

Cost Of Buying House In Malaysia

How To Calculate Legal Fees Stamp Duty For My Property Purchased Property Malaysia

0 Response to "how to calculate stamp duty malaysia"

Post a Comment